Motor/Car insurance is essential for car owners, providing financial protection against unforeseen events.

There are three main categories of motor/car insurance. Each type serves a distinct purpose and varies in coverage, ensuring that car owners can choose the policy that best fits their needs.

Comprehensive Car Insurance

This goes beyond the coverage offered by Third Party Insurance

This type includes protection against damage to the insured vehicle caused by accidents, theft, vandalism, or natural disasters, in addition to third-party liability coverage. For car owners who desire extensive security, Comprehensive Car Insurance is an optimal choice, as it provides peace of mind in various scenarios. Furthermore, it often includes additional benefits, such as coverage for personal belongings inside the vehicle and roadside assistance.

Third Party Insurance

This is the minimum legal requirement for every car/vehicle on Indian roads

This type of insurance covers the liabilities arising from damage to third-party property or injury to third-party individuals in the event of an accident where the insured is at fault. It does not, however, cover any damage to the insured vehicle or injuries suffered by the driver or passengers. By selecting Third Party Insurance, car owners fulfil their legal obligations while securing basic protection against potential liabilities.

Standalone Own Damage Insurance

This is another option available to car owners

This insurance provides coverage specifically for the damages incurred by the insured vehicle due to accidents, theft, or natural calamities, without any third-party liability protection. While this option may be suitable for those who already have separate third-party coverage, it is essential to evaluate one’s specific requirements. Choosing the right type of motor insurance ensures financial security and legal compliance, ultimately safeguarding car owners against the unpredictability of the road.

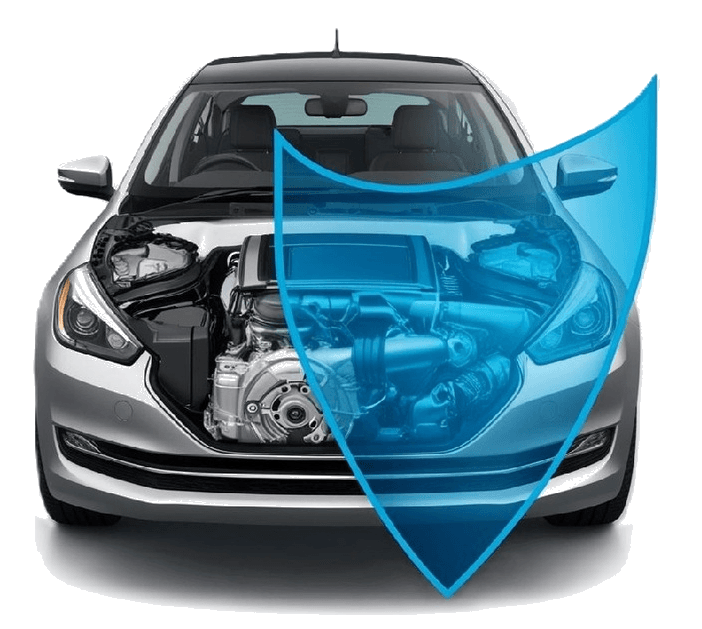

Understanding Comprehensive Car Insurance

Comprehensive car insurance is a crucial element of vehicle protection that goes beyond the basic requirements of liability coverage. This type of insurance provides extensive coverage for damages to the insured’s vehicle caused by a large number of risks. These risks include, but are not limited to, accidents, theft, vandalism, and natural calamities, such as floods and hurricanes.

By offering this broad range of protection, comprehensive car insurance ensures that car owners are not left financially vulnerable in the aftermath of unexpected events.

One of the standout features of comprehensive car insurance is its ability to cover third-party liabilities while also safeguarding the owner’s own vehicle. This dual protection is vital, as it not only assists in covering damages inflicted upon other vehicles or property but also addresses the potential substantial repair or replacement costs associated with one’s own vehicle. Therefore, car owners can have peace of mind knowing their financial obligations are mitigated in the event of an unforeseen incident.

Moreover, the significance of financial protection afforded by comprehensive car insurance cannot be overstated. In a world full of uncertainties, the reassurance that comes with having coverage for a wide array of risks allows car owners to operate their vehicles with confidence. Without comprehensive coverage, the burden of unexpected expenditures resulting from theft or damage could lead to significant financial strain. The psychological security offered by knowing that one’s vehicle is protected against various risks is invaluable, making comprehensive car insurance an essential consideration for responsible vehicle ownership.

In this complex landscape of automotive risks, comprehensive car insurance serves as a protective shield, enabling owners to navigate the uncertainties of vehicle ownership with greater assurance and resilience.

Standalone Own Damage Insurance and Add-On Covers

Standalone Own Damage Insurance is a specialised type of motor insurance that allows car owners to protect their vehicles specifically against damages incurred from accidents, theft, natural calamities, and other unforeseen events. This insurance does not cover third-party liabilities; rather, it focuses solely on the damage sustained by the policyholder’s own vehicle. For car owners looking to enhance their protection, opting for a standalone policy can be a prudent choice, especially for those who wish to prioritize their vehicle’s safety and value without the complexities of third-party coverage.

In addition to the primary coverage provided by Standalone Own Damage Insurance, various add-on covers are available, which can significantly enhance the protection of a vehicle. These are Zero Depreciation, Consumables coverage, Engine cover, Road Side Assistance, Key Replacement, NCB Protection, Return To Invoice (RTI), and more to cover your car, two wheelers, etc.

From these add-ons ZERO Depreciation cover stands out as it ensures that the insured amount does not take depreciation into account. In the event of a claim, this means that the car owner receives the full value for repairs or replacement, which can result in substantial savings and peace of mind.

Consumables Coverage, includes expenses related to items that are often excluded from standard policies, such as engine oil, brake fluids, coolant, screws and other consumables required during repairs. With this add-on, you can ensure comprehensive protection, eliminating out-of-pocket expenses for these essential materials.

Engine Cover is an addition, safeguarding the automobile’s engine against damages caused by water ingress or oil leakage. This cover can be especially valuable for those living in regions prone to flooding or heavy rains.

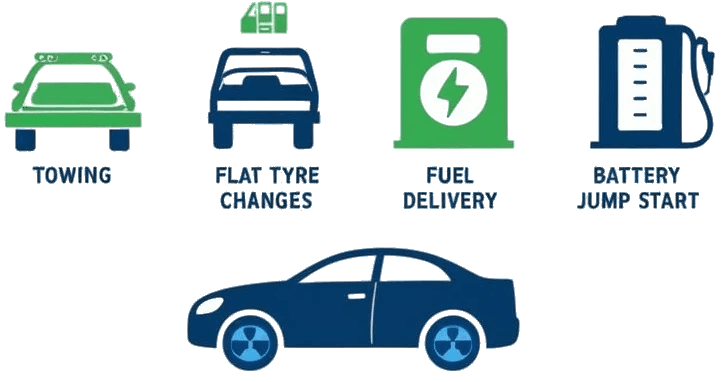

The Roadside Assistance (RSA) add-on provides support in emergencies, offering services such as towing, flat tyre changes, fuel delivery, battery jump start, etc. This can be crucial you frequently travel long distances or navigate less familiar areas. This emergency assistance at a nominal premium comes to use when it is most needed.

In conclusion, Standalone Own Damage Insurance combined with suitable add-on covers provides enhanced protection for your vehicles, reinforcing your investment during challenging situations. By carefully selecting the applicable add-ons, you can secure both your financial interests and personal safety on the road. It is important to choose the enhanced protection wisely, as each add-on cover, comes at an extra premium. Talk to us to know more.

Engine Cover

Engine Cover is an addition, safeguarding the automobile's engine against damages caused by water ingress or oil leakage. This cover can be especially valuable for those living in regions prone to flooding or heavy rains.

Roadside Assistance

The Roadside Assistance (RSA) add-on provides support in emergencies, offering services such as towing, flat tyre changes, fuel delivery, battery jump start, etc. Imagine a break-down amidst an enjoyable drive or a pleasant ride, that you are forced to halt, get stuck in an insurance odd hour you travel. This emergency assistance at a nominal premium comes to use when it is most needed.

Zero Depreciation

From these add-ons ZERO Depreciation cover stands out as it ensures that the insured amount does not take depreciation into account. In the event of a claim, this means that the car owner receives the full value for repairs or replacement, which can result in substantial savings and peace of mind.

Consumables Coverage

Consumables Coverage, includes expenses related to items that are often excluded from standard policies, such as engine oil, brake fluids, coolant, screws and other consumables required during repairs. With this add-on, you can ensure comprehensive protection, eliminating out-of-pocket expenses for these essential materials.

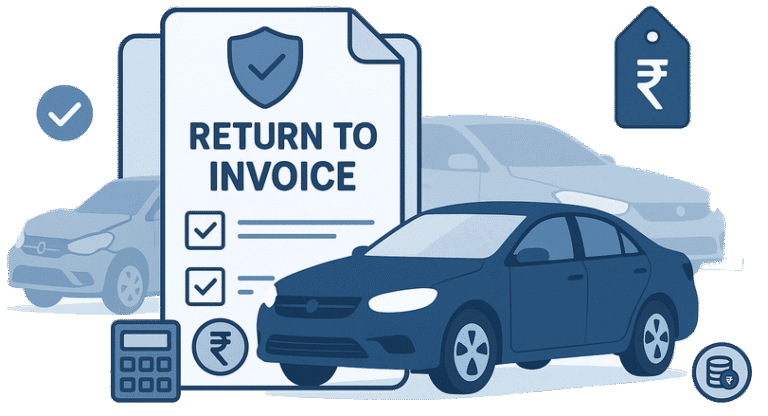

Return to Invoice

For those who love their cars dearly is Return To Invoice. It is an add-on cover in car insurance that ensures you receive the original purchase price of your vehicle, including taxes and registration fees, in cases of total loss or theft. This coverage bridges the gap between the depreciated Insured Declared Value (IDV) and the actual amount you paid for the car.

Car Exclusions

Cashless Network Garages in India

Your New Car Deserves the Best Protection Drive with Confidence

Congratulations on your new car! The feeling of that new steering wheel, the pristine interiors, and the open road ahead is unparalleled. As you embark on countless journeys, the most important accessory you can have is not on the dashboard—it’s the peace of mind that comes with complete protection.

At Fine Life Secure Solutions, we don’t just sell policies; we build a shield of security around your prized possession. We are here to ensure you get the right coverage, so you can focus on enjoying the drive.

Why Choose Us for Your New Car Insurance?

Navigating the world of insurance can be complex. We make it simple, transparent, and tailored to you.

- Expert Guidance: We understand the nuances of motor insurance. We listen to your needs and recommend the best plan, not the most expensive one.

- Complete Market Access: We partner with India’s leading insurance companies, giving you access to a wide range of options and the most competitive premiums in one place.

- Dedicated Claims Support: In the unfortunate event of a claim, you’re not alone. We guide you through the entire process, ensuring a fast and hassle-free experience.

- Instant Policy Issuance: No waiting, no delays. Get your policy document in your inbox moments after you make the decision.

The Agent Advantage: More Than Just a Policy

Buying online from a portal is an option, but purchasing through our agency is an experience

Core Features of Our New Car Insurance Plans

The Agent Advantage: More Than Just a Policy

Buying online from a portal is an option, but purchasing through our agency is an experience. Here is the value we add:

Unlock Your Loyalty Bonus: Transfer Your No Claim Bonus (NCB)

Have you sold your old car to buy this new one? Your years of safe driving are a valuable asset that you can bring with you. Many car owners mistakenly believe their No Claim Bonus (NCB) is lost when they sell their vehicle. The truth is, your NCB is a reward for you, the owner driver, not the car.

You can transfer this bonus and get a substantial discount—up to 50%—on your new car’s insurance premium!

How We Make NCB Transfer Effortless

The process of retaining and transferring your NCB involves specific documentation and coordination with your previous insurer. This is where we step in to make it simple and seamless.

- Expert Handling: We manage the paperwork required to obtain your NCB Retention Certificate from your previous insurance provider.

- Timely Application: We ensure your earned bonus is applied correctly and instantly to your new car’s policy, maximising your savings from day one.

- No More Hassle: We handle the entire process on your behalf, ensuring you get every rupee of discount you deserve.

By letting us manage your NCB transfer, you are not just buying a policy; you are ensuring that your good driving history pays you back.

- Personalised Risk Assessment: We help you understand what add-ons are truly necessary for your specific car model and driving habits, saving you money on what you don’t need.

- Annual Policy Review: Before your renewal, we proactively review your policy, check for better deals, and ensure your Insured Declared Value (IDV) is accurate.

- Clarity and Transparency: We break down the policy jargon into simple terms, ensuring you understand exactly what you are paying for.

Ready to Protect Your New Car?

Your journey with your new car should be worry-free.

Let us take care. Talk to us Today!

- Call Us: +91 98198 66188

- Email: care@finelifesecure.com

- Request a Callback: Fill out our simple form, and we will call you back within 30 minutes.

Car insurance is not only a legal requirement, but also a necessity for every car owner in India.

Driving without car insurance can have serious repercussions

- You may have to pay a hefty fine of Rs. 2000 or more, or face imprisonment for up to three months, or both, as per the Motor Vehicles Act, 1988.

- You may lose your driving licence or registration certificate, or both, as per the Motor Vehicles Act, 1988.

- You may have to bear the entire cost of repairing or replacing your car in case of any damage or loss.

- You may have to pay for the medical expenses of yourself or others who are injured in an accident involving your car.

- You may have to compensate the third parties for any injury, death, or property damage caused by your car.

- You may have to face legal action or lawsuits from the third parties or their insurers for any claim arising out of your car.

- You may have to face a higher premium or difficulty in getting a new car insurance policy in the future.

These are some of the consequences that you may have to face or deal otherwise without appropriate insurance cover for your car. Therefore, it is important to understand the importance of car insurance and renew it on time.

Your Car Insurance, renewal is Simple, Efficient, Secure, and a Seamless process

Renewing your car insurance perhaps has never been easier for many, with overwhelming choices or with little options for a right coverage, without premium coverage transparency. Our comprehensive services provide:

• Multiple insurance plan options

• Customizable add-on covers

• Hassle free online renewal channels

• Competitive pricing, with complete understanding of what you buy.

Professional Guidance at Your Service, while you buy, renew, and in times of emergency when you need the most.

Car insurance is not a luxury, but a necessity for your car.

Protect yourself, your vehicle, and your financial interests. Renew your car insurance policy today and drive with confidence.

Bike & Scooter Insurance

Two-wheeler insurance, also known as bike or scooter insurance, is a policy designed to provide financial protection against damages or losses incurred due to accidents, theft, fire, natural disasters, or third-party liabilities associated with your motorcycle or scooter. In India, it is mandatory to have at least third-party insurance for all two-wheelers registered on the road, as per the guidelines set by the Insurance Regulatory and Development Authority of India (IRDAI).

Two-wheeler insurance is a crucial aspect of responsible bike ownership, providing essential coverage against legal liabilities, financial losses, and peace of mind on the road. Understanding the types of policies available, key features and benefits, and what to consider when selecting your plan will help ensure you choose the right coverage for your needs.

Why Is Two-Wheeler Insurance Important?

Third-party insurance is a mandatory liability insurance against legal liabilities arising from damages or injuries caused to a third party, and is a legal requirement for all vehicles under the Motor Vehicles Act

A comprehensive insurance protects you from the financial losses due to damage to your two-wheeler due to accident, theft, natural calamities, thus reducing the financial burden of repairs or replacement. Also from the legal liability to third party injury, and third party property damage.

Being insured allows you to ride without worry, knowing you are protected from unforeseen circumstances.

Two-wheeler insurance covers any legal liabilities arising from accidents that cause injury or damage to a third party.

Key Features and Benefits of Two-Wheeler Insurance

Ensures you are not financially burdened by repairs and legal costs after an incident.

Policies can be tailored to fit your needs, including various add-on options.

Discounts on premium for every claim-free year, reducing your renewal costs.

Access to a network of garages for cashless repair services.

Provides coverage for you and your passengers in case of injury or death in an accident.

Streamlined procedures for filing claims, often with availability of 24/7 support.

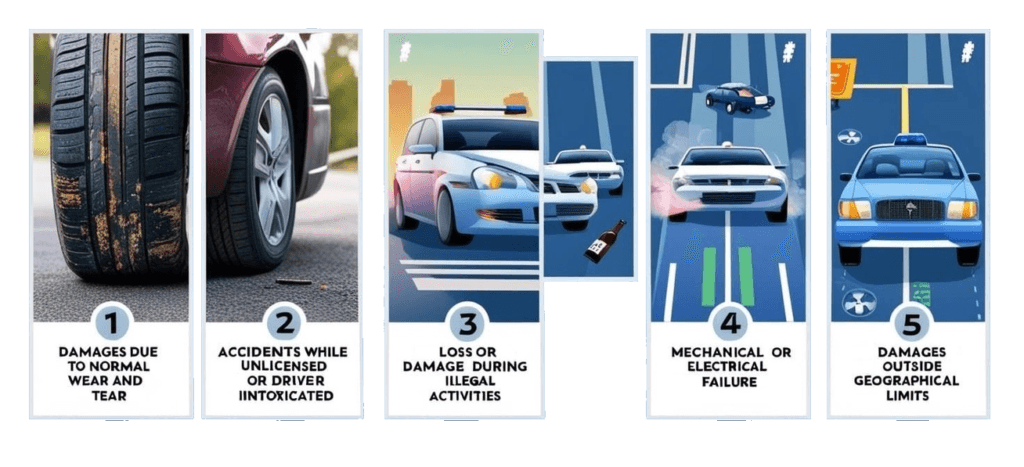

Common Exclusions Under Two-Wheeler Insurance:

- Damages due to normal wear and tear.

- Accidents occurring while riding without a valid driving license or under the influence of alcohol/drugs.

- Loss or damage caused while using the vehicle for illegal activities.

- Mechanical or electrical failure.

- Damages incurred outside the geographical limits specified in the policy.

Understanding Compulsory Personal Accident Cover for Owner-Driver

As mandated by the Insurance Regulatory and Development Authority of India (IRDAI), every Owner-Driver must have a Compulsory Personal Accident (PA) Cover with a minimum Sum Insured of ₹15 Lakhs as part of their motor insurance policy. This essential cover provides financial protection in case of accidental death or permanent disability while the owner-driver is driving, mounting, or dismounting the vehicle.

What Does the Compulsory Owner-Driver PA Cover Include?

- Coverage Amount: Minimum ₹15,00,000 (15 Lakhs) Sum Insured.

- Scope of Protection: Provides a safety net for the insured’s family in case of accidental death, permanent total disability, or permanent partial disability arising from an accident involving the insured vehicle.

- Mandate Compliance: If you choose not to opt for this cover through your vehicle insurance, you must declare that you already have an existing Personal Accident policy with a similar coverage amount or that you do not possess a valid driving license. Any false declarations may lead to claim repudiation.

Why Opt for Additional Individual Personal Accident Benefit?

While the compulsory PA cover offers essential protection, it is limited to accidents involving your vehicle. Accidents can occur anytime, anywhere—whether at home, on the street, or even due to unforeseen events such as elevator malfunctions or pedestrian mishaps. That’s why customizing your protection with an Individual Personal Accident Benefit policy is a wise choice.

Beyond just driving-related accidents, this plan covers personal accidents in various circumstances, tailored to your lifestyle and occupation.

Choose coverage amounts that suit your financial needs and family’s security.

Enhanced safety with minimal additional cost, offering peace of mind beyond mandatory requirements.

Before finalizing your car, bike, or any vehicle insurance, talk to our experts! We help you choose the right personal accident benefits to ensure comprehensive protection for you and your loved ones.

Zero Depreciation

Ensures full reimbursement for damages without factoring in depreciation.

Engine & Gearbox Protection

Covers repairs or replacements of engine and gearbox due to water ingress or other damages.

Personal Accident Cover

Enhanced coverage for injuries to the rider or pillion.

Roadsie Assistance

Offers services like towing, fuel delivery, and mechanical assistance.

Start your journey with confidence. We are here to guide you and address any questions or concerns you may have. Your premium is more than just a payment – it’s our commitment to your well-being.

Frequently Asked Questions (FAQs) – Car & Bike Insurance

1. Is the Owner-Driver Personal Accident cover mandatory for all vehicle owners?

Yes. IRDAI mandates every Owner-Driver to have a compulsory Personal Accident cover with a minimum Sum Insured of ₹15 Lakhs, included with your motor insurance.

2. What happens if I already have a Personal Accident policy?

You must declare it while purchasing your vehicle insurance. Otherwise, not opting for the compulsory cover may result in claim denial.

3. Does the compulsory PA cover protect me outside of driving my vehicle?

No. The compulsory cover is restricted to accidents occurring while driving, mounting, or dismounting your vehicle. For broader accident protection, consider an Individual Personal Accident Benefit policy.

4. What is the difference between a Co-payment and Deductible?

Co-payment: The fixed percentage of the claim amount that the insured must pay out of pocket at the time of hospitalization. For example, if the co-payment is 10%, the policyholder will pay 10% of the claim, and the insurer pays the remaining 90%.

Deductible: The amount the policyholder must pay before the insurance policy kicks in. For example, if your deductible is ₹10,000, the insurer will only start covering expenses once the deductible amount is paid.

5. Can I increase the sum insured beyond ₹15 Lakhs?

Yes, you can enhance your protection by opting for higher coverage limits under the Individual Personal Accident Benefit plans, usually at a nominal additional premium.